Dividends and Distribution of Profits

Basic Policy Regarding Distribution of Profits and Dividends of This Period

We will implement steady dividends targeting a consolidated dividend on equity ratio (DOE) of 4.0%, with profit return to shareholders through dividends as one of our most important measures.

[Basic concept]

DOE 4.0% = Aimed ROE level 10.0% × dividend payout ratio 40%

Cash dividends per share for March 2026 is expected to be 94 yen.

Annual dividend per share (yen)

| Interim dividend | Year-end dividend | Annual dividend | |

|---|---|---|---|

| 2014/3 | 10 yen | 12.5 yen | 22.5 yen |

| 2015/3 | 10 yen | 16 yen | 26 yen |

| 2016/3 | 12.5 yen | 21 yen | 33.5 yen |

| 2017/3 | 12.5 yen | 22.5 yen | 35 yen |

| 2018/3 | 12.5 yen | 25 yen | 37.5 yen |

| 2019/3 | 12.5 yen | 33 yen | 45.5 yen |

| 2020/3 | 15 yen | 35 yen | 50 yen |

| 2021/3 | 15 yen | 30 yen | 45 yen |

| 2022/3 | 15 yen | 35 yen | 50 yen |

| 2023/3 | 25 yen | 35.5 yen | 60.5 yen |

| 2024/3 | 25 yen | 40.5 yen | 60.5 yen |

| 2025/3 | 30 yen | 42 yen | 72 yen |

-

※A 2-for-1 share split of common shares was conducted on April 1, 2025.

Annual dividend amounts before the fiscal year ended March 31, 2025, were calculated assuming that the stock split had been conducted.

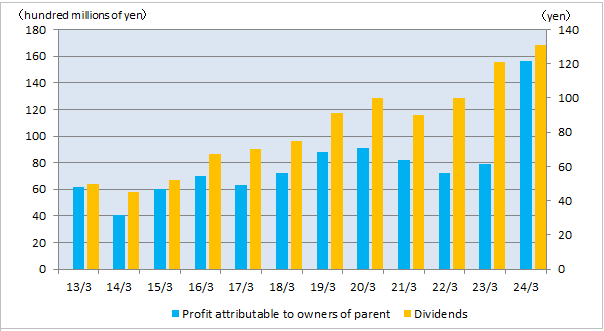

Profit attributable to owners of parent and Dividends

Profit attributable to owners of parent and Dividends

Complimentary programs for shareholders

We do not offer complimentary programs for shareholders. As our basic policy, we distribute profits via dividends to our shareholders.